History

With a strong foundation, deeply rooted values and a clear vision, the future for Ovintiv is focused on technology and innovation, a multi-basin portfolio of scale and top tier talent.

Foundation of a North American Resource Play Leader

Ovintiv is one of North America’s oldest oil and natural gas producers. Our roots go back to the late 1800s when workers for the Canadian Pacific Railway (CPR) drilling a water well discovered natural gas. We opted to make use of this newly discovered resource. In 1884, CPR drilled the first producing gas well in Alberta, Canada, to supply railway buildings with natural gas. That well was in use for about 50 years.

The Evolution of Horizontal Drilling

Innovation has been the driving force behind Ovintiv’s evolution. For decades, we have been at the forefront of oil and natural gas exploration and development. Ovintiv was among the first in the oil and natural gas industry to use slant drilling techniques on a large scale to drive performance. From the late 1970s to the early 1990s, we credited our industry leading position to continuing advancements in slant drilling. These techniques enabled the use of multi-well pads and better targeting.

Starting the Unconventional Revolution

Since the early 2000s, Ovintiv has focused on North American “resource plays,” a term it coined for unconventional resources locked deep in tight sands and shales. In 2007, Ovintiv’s culture of knowledge sharing led to the transfer of horizontal drilling techniques, first employed in the Barnett Shale of Texas, to Canada’s Montney formation, where it was successfully refined and returned to Texas.

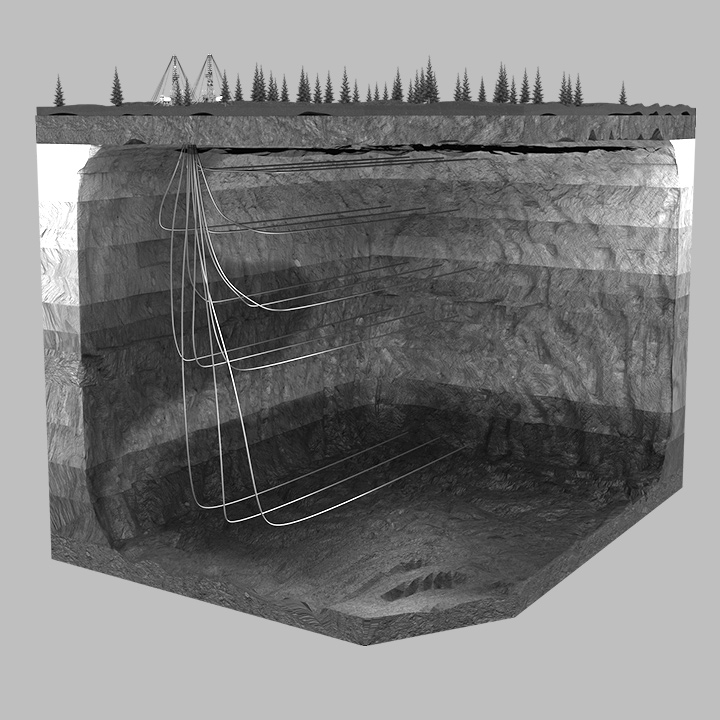

3D Cube Development

Ovintiv’s entry into basins with multiple, stacked layers of resource led to the next advancement in the shale revolution—the cube. Deploying multiple rigs on a single large pad, the layers of resource are drilled and completed simultaneously, maximizing economic recovery. The cube has set the standard for development of multiple stacked resources, moving beyond drilling and previous completions techniques.

Our Future is Innovation

Driven by innovation and a clear vision, Ovintiv is positioned to thrive and grow in today’s market. By focusing on continuous operational excellence in our top tier assets, and a disciplined capital allocation approach, we are poised to lead in all areas where we operate.