Our Approach

Vision

Vision

We will be at the forefront of driving innovation to both profitably and sustainably produce oil and gas from shale.

Proven Results

Each year, since 2018, we have generated free cash flow and have returned nearly $2 billion to our shareholders.

Mission

Mission

Our products fuel the world — we make modern life possible. As one of the largest producers of oil and natural gas in North America, our team stands united by a commitment to drive progress and improve lives with respect and responsibility, not just in the communities where we operate, but for everyone.

Our products provide energy, which in turn supports better education, healthcare and equality opportunities. We will continue to pioneer innovative ways to provide safe, reliable and affordable energy.

Values

Values

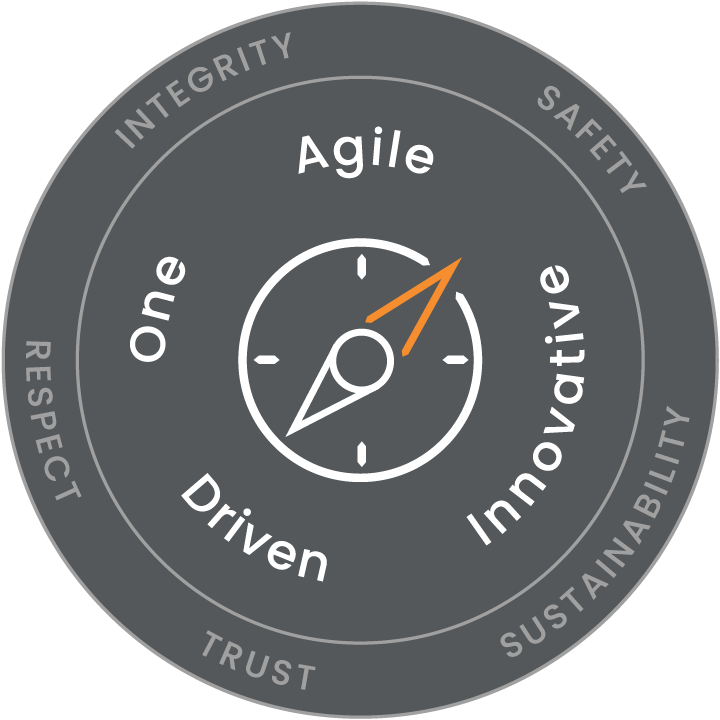

Our core values of one, agile, innovative and driven guide our actions. Our foundational values of integrity, safety, sustainability, trust and respect guide our behavior and define what we expect of ourselves and others in the workplace. Our pride is reflected not only in what we achieve, but also in how we accomplish it.

One

We achieve greater results working together, we value collaboration in advancing our common goals.

Agile

We are proactive in identifying opportunity and take action to capture value.

Innovative

We differentiate through innovation. We achieve extraordinary results by applying novel solutions to meaningful opportunities.

Driven

We are motivated by purpose – to make modern life possible.

We set high standards and are accountable in delivering results.

Integrity

We act ethically and honestly, honoring our commitments and responsibilities.

Safety

We care about the health, wellbeing and safety of people above all.

Sustainability

We are committed to improving our quality of life in a way that does not compromise the future.

Trust

We are truthful, deliver on our promises and uphold our commitments.

Respect

We value individual differences, diverse perspectives and unique talents.

Approach

Ovintiv has been at the forefront of our industry’s transition to a “new” business model. We are focused on generating free cash flow and delivering quality returns.

We are powered by our unique culture of innovation, teamwork and discipline. We relentlessly innovate to drive efficiency in every part of our business.

We manage risk by continuously driving efficiency gains, creating optionality across our multi-product and multi-basin portfolio, building flexibility into all our commercial arrangements and through commodity price risk management.

The combination of our top tier assets, our efficiency and our discipline enable us to sustainably deliver quality returns through the cycle.